|

best dog medical insurance comparison guide for value-focused ownersPicking a policy that actually pays when it matters means looking past glossy ads and into definitions, limits, and claims behavior. Below is a side-by-side style walkthrough to help you judge value with confidence. What actually drives value- Coverage scope: Accident + illness is the core; check hereditary/congenital, chronic, cancer, orthopedic, and rehab/physio.

- Limits: Annual cap, per-incident cap, or unlimited. Unlimited smooths big years but costs more.

- Cost levers: Deductible (per-incident vs annual), reimbursement (70 - 90%), and coinsurance. Higher deductible + lower reimbursement trims premiums.

- Claims and payout: Average days to reimburse, option for direct vet pay, weekend processing, and in-app EOB clarity.

- Vet choice: Most use open networks; confirm coverage at any licensed vet, emergency, and specialty hospitals.

- Waiting periods: Standard 2 - 15 days; knees/hips may have special waits unless you pass an orthopedic exam.

- Exclusions: Pre-existing, bilateral clauses (e.g., one torn knee excludes the other), breeding, cosmetic procedures.

- Age rules: Enrollment caps for seniors and whether renewal is guaranteed for life.

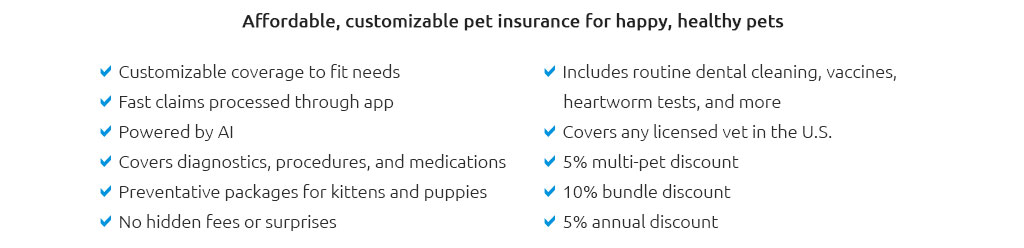

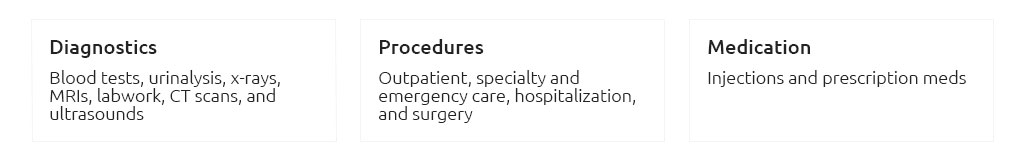

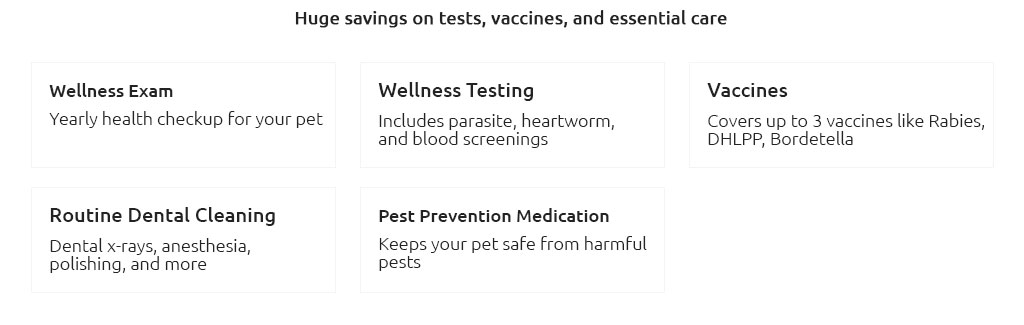

- Add-ons: Dental illness, behavioral therapy, prescription meds/foods, alternative care, end-of-life.

- Support: 24/7 tele-vet, pre-approvals, live chat, and clear sample policy PDFs.

Plan types comparedAccident-onlyLowest price; covers injuries like fractures or foreign-body ingestion. Good stopgap for seniors or tight budgets, but no illness coverage means cancers, allergies, and GI diseases aren't included. Accident + Illness (core)The mainstream pick. Look for chronic condition continuity, cancer care, imaging, specialist referrals, and hospitalization. This is where most "best" value lives for the average dog. Comprehensive + extrasCore coverage plus rehab, dental illness, behavioral, exam fees, and sometimes wellness. Costs rise, but extras can net out if you'll realistically use them. Typical price bands (ballpark)Young small mixed-breed: often $20 - $40/mo for 80% reimbursement, $10k - unlimited limit. Large breeds or purebreds: $40 - $90+. Seniors: $70 - $150+ depending on limits, region, and claims history. Urban ZIPs tend to be higher. Offers that can tilt the math- Multi-pet discounts and annual-pay savings.

- Intro promos like exam-fee coverage or waived waiting periods after a vet check.

- Orthopedic waiver with a clean exam to shorten knee/hip waits.

- Healthy-pet credits or vanishing deductibles after claim-free years.

- Direct vet pay so you're not fronting a $3,000 bill on a weekend.

- Employer benefits and member group discounts worth asking about.

A real-world momentAt 11 p.m., my dog limped off the couch and wouldn't bear weight. ER radiographs, pain meds, and a splint totaled $2,280. I filed from the parking lot; the insurer pre-approved direct pay for follow-up, and 80% reimbursement hit my account in five days - what mattered most under stress wasn't the brochure; it was speed, clarity, and a reachable support chat. Quick heuristics by situation- Puppy or large-breed athlete: Prioritize unlimited or $15k+ limit, orthopedic coverage, and rehab; add exam-fee coverage if you visit specialists.

- Adult mixed-breed, stable health: $10k annual limit, 80% reimbursement, $250 - $500 annual deductible balances cost and protection.

- Senior adoption: Accident + illness if allowed; if not, accident-only beats nothing. Confirm chronic continuity and no new-condition age caps.

- Budget-sensitive households: Keep core coverage but set a higher deductible and 70% reimbursement, then earmark savings in an emergency fund.

Red flags in the fine print- Pre-existing definitions: Look for "curable" clauses that may allow coverage after a symptom-free window.

- Bilateral conditions: One knee or hip issue might exclude the other side - read that section twice.

- Dental: Injury is common; illness (periodontal, extractions) often needs an add-on.

- Prescription diets: Often excluded or capped; meds usually covered.

- Alternative therapies: Acupuncture, laser, hydrotherapy may require an add-on and a vet referral.

- Travel: Out-of-state or international coverage varies.

- End-of-life: Euthanasia and cremation coverage differs by plan.

Compare five quotes in 15 minutes- List must-haves: chronic coverage, cancer, imaging, specialist referrals, rehab.

- Pick a target setup: $10k vs unlimited; 80% reimbursement; $250 - $500 deductible.

- Pull three to five quotes with the same settings; note price jumps from $10k to unlimited.

- Open each sample policy PDF; read coverage, exclusions, waiting periods, orthopedic terms.

- Run a $3,000 claim math test: deductible + coinsurance across your top picks.

- Check claim speed evidence: average days, weekend processing, direct pay availability.

- Email support one hypothetical (e.g., TPLO surgery) and save their written response.

Fast answersIs wellness worth it?Only if the add-on roughly equals what you'd pay anyway for vaccines, tests, and dental cleanings; otherwise, keep cash flow simple. Can I switch later?You can, but new plans won't cover prior issues. Better to adjust deductible/reimbursement within your existing policy if possible. What reimbursement should I pick?80% is a solid middle ground; drop to 70% to cut premiums or go 90% for high-cost metros and referral-heavy care. Annual vs per-incident deductibles?Annual is simpler for chronic issues; per-incident can be cheaper if claims are rare and unrelated. Bottom lineThe best dog medical insurance is the one that clearly covers the risks your dog actually faces, pays out quickly, and stays affordable after year one. Compare core benefits first, layer in extras only if you'll use them, and keep a short note of quotes and fine-print highlights so you can revisit as your dog - and your budget - change over time.

|

|